Which Loan Type Should Military Home Buyers Choose: Conventional, FHA or VA?

California leads the entire country in regards to states with the largest military population at 184,540 as of September 2017 according to Dept. of Defense personnel data. Most are based in the Southern California areas of San Diego, Riverside County and Orange County. That means military members from active duty, reserves and veterans, are in a position to obtain a VA loan to purchase a home.

While VA loans are attractive for various reasons, military members have other loan programs available to them as well. At this time, we’ll review some of the main differences between VA, FHA and conventional loans, from the viewpoint of a military home buyer in California.

Conventional, FHA or VA: Best Type of Loan for Armed Forces Home Buyers?

Whether you are retired or actively serving in the military, home buyers have multiple loan types to consider. Their financing options consists of either; Conventional, Federal Housing Administration (FHA), or the Department of Veterans Affairs (VA). Keep in mind that conventional (traditional) loans are not insured by the government.

Like any financing product, your budget and additional factors play a large part in what is best. The following are the main distinctions and aspects among the three choices:

VA loan overview:

Loans are guaranteed up to 25% of the county loan limit by the VA unless less than $144,000

A maximum of 100% financing (zero down payment) if borrower is within county loan limits

Borrowers do not pay mortgage insurance with less than 20-percent down

VA funding fee varies from 2.15% to 3.3% for zero down loans; 1.25% to 1.75% with 5-10 percent down

Credit score requirements are not applicable although some lender have overlaying guidelines

Borrower needs to have a Certificate of Eligibility (COE) from the VA to apply

Interest rates are usually the lowest of the three options

FHA loans overview:

Loans are insured by the Federal Housing Administration (FHA)

Offers financing up to 96.5%, for a down payment of just 3.5% for credit scores over 580

Upfront mortgage insurance fee of 1.75% for many home buyers

Yearly mortgage insurance works out to be 0.85% for the majority of FHA borrowers

Credit scores as low as 500 and debt to income ratios as much as 55 allowed

Borrowers must meet guidelines set by Department of Housing and Urban Development

Conventional loans overview:

Loans are not insured by the government

Financing offered up to 97% for qualified borrowers, or a down payment of only 3%

Mortgage insurance (MI) of.51% of loan amount is often necessary for down payment less than 20%

Borrowers have no option to roll mortgage insurance fees into the loan balance

Credit score necessary is 620 and debt to income ratios are relatively more strict than FHA and VA

No Down Payment, No Mortgage Insurance

For most of the armed forces members looking to buy a home in California, the VA mortgage loan is often the better choice than an FHA or conventional loan. A big reason is because it enables eligible borrowers to buy a home with zero money down, get a low 30-year fixed rate, and not have to pay mortgage insurance. Those are some huge benefits of why the VA mortgage is so popular.

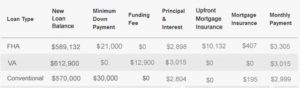

If you compare FHA,Conventional and VA from the chart below for a home of $600,000 you’ll find some easy advantages with the VA loan due to the 100% financing that’s available.