Orange County FHA Loan Limits Increased for 2022

Summary: Due to an increase in home prices in Orange County, FHA loan limits in Orange County, California have risen for the year 2021. In this blog post, we’ll go over the amount the limits went up for 2021 in Orange County, and how it affects you.

If you’re one of the many prospective home buyers who may not have the credit score or down payment amount required to obtain a conventional loan to purchase a home in Orange County, an FHA home loan is a very good choice. Nonetheless, prior to applying for an FHA loan, you need to make sure that the new loan limit will help you.

In Orange County, California, the FHA loan limit is $970,800.

During the first week of December in 2021, The Department of Housing and Urban Development (HUD) announced that it would be raising FHA loan limits in all counties across the US. Due to home price appreciation across most of the nation in 2021 the increase in loan limit was warranted.

These changes will apply to FHA loans assigned on or after January 1, 2022, through the end of 2022.

Orange County FHA Loan Limits in 2022

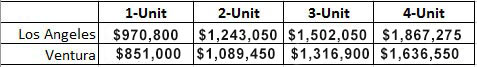

The single-family FHA loan limit for Orange County, California is $970,800 in 2022. The maximum FHA loan limit for 2-, 3-, and 4-unit properties will also rise, as displayed in the table below.

Review the 2021 limits for Orange County, for all property types:

• Single-family home/Condo/Townhome: $970,800

• Duplex | Two-family property: $1,243,050

• Triplex | Three-unit property: $1,502,475

• Fourplex | 4 Unit property: $1,867,275

In connection with an Increase in Property Values, the Federal Housing Administration (FHA) determined its loan limits based on median house prices, as stated by the National Housing Act.

This is the reason why the same loan limits are applied to the entire Los Angeles metro area, including Orange County, shown clearly in the table below:

HUD tends to raise loan limits from one year to the next mainly to address the rise in home values. Based on data from Zillow, property values throughout the country went up by approximately 19.5% since December 2020.

The prices did not rise as much in Orange County, but they still rose by 15.7% during the past 12 months, and FHA loan limits for 2022 have been boosted accordingly.

As of November 2021, the National Association of Realtors said the median sold home price in Orange County was $955,000. This is above the single-family FHA loan limit. What this means for buyers who use this loan program is they will have more homes to pick from up to $1,006,010 with a 3.5% down payment.

See the list of FHA loan limits for all counties in the state of California.

Considering using the FHA Loan Program?

If you are thinking of buying a home in Orange County, California in 2022, or you need more info about FHA loan limits for 2022, we are here to help.